Step - 16 Life Insurance

Step 16

Obviously, life insurance isn’t something you can just get, there is a cost to it and you have to qualify for it medically.

For me to get a better understanding, do you or your spouse smoke or have any medical issues whatsoever?

High Blood Pressure? Diabetes? Are you on any medications?

Great

Now Mr. And Mrs._________, I’m sure that you would agree that money is always an issue when it comes to these things... How much do you feel you could comfortably put towards the program, on a monthly basis, to make sure your family is properly protected? Before you answer that, most of our clients say somewhere between $50-$100 per/mth, some say alittle more than that maybe $100-$200 per/mth, and some of them even say as little $30-$40per/mth. Mr. And Mrs._______ where do you feel like you can comfortably be? $_______

Okay perfect, I am going to work on some numbers for you just give me a few moments

*Click on the top right arrow*

Step 16

Stop Share

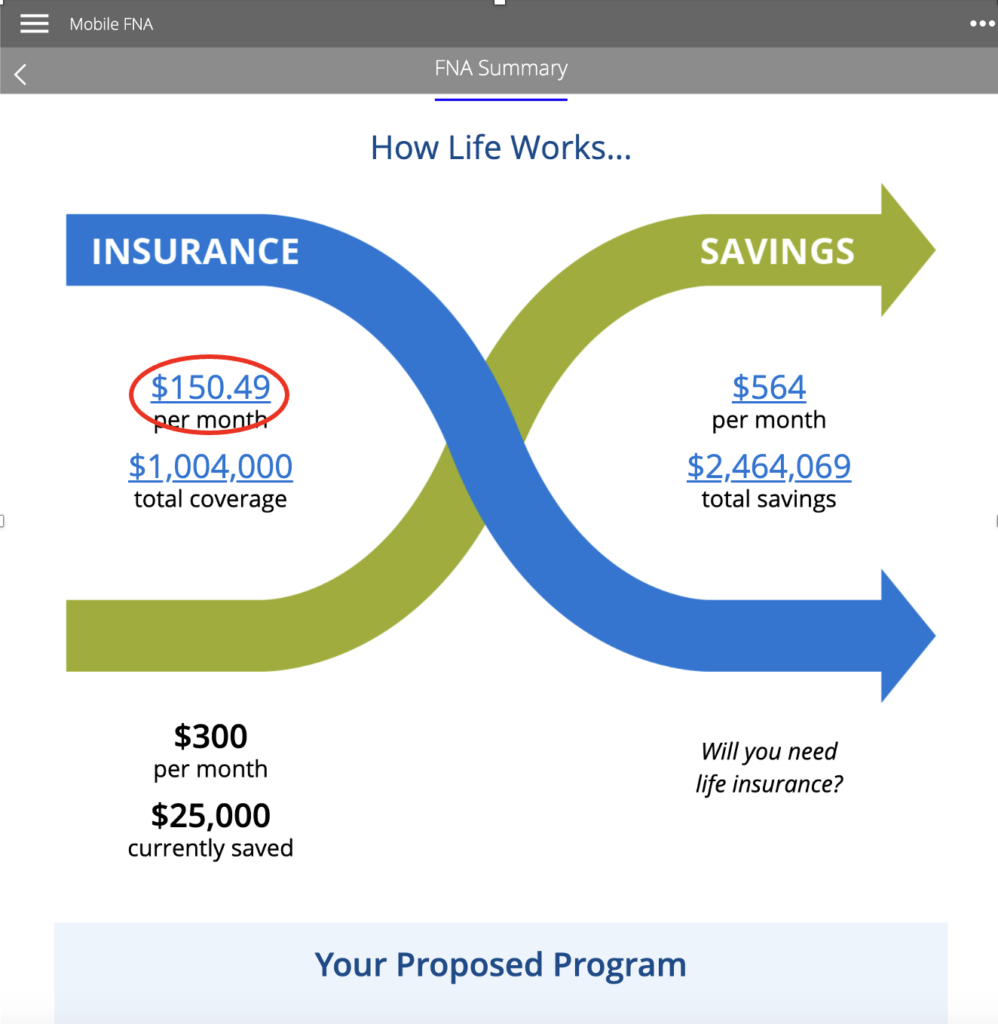

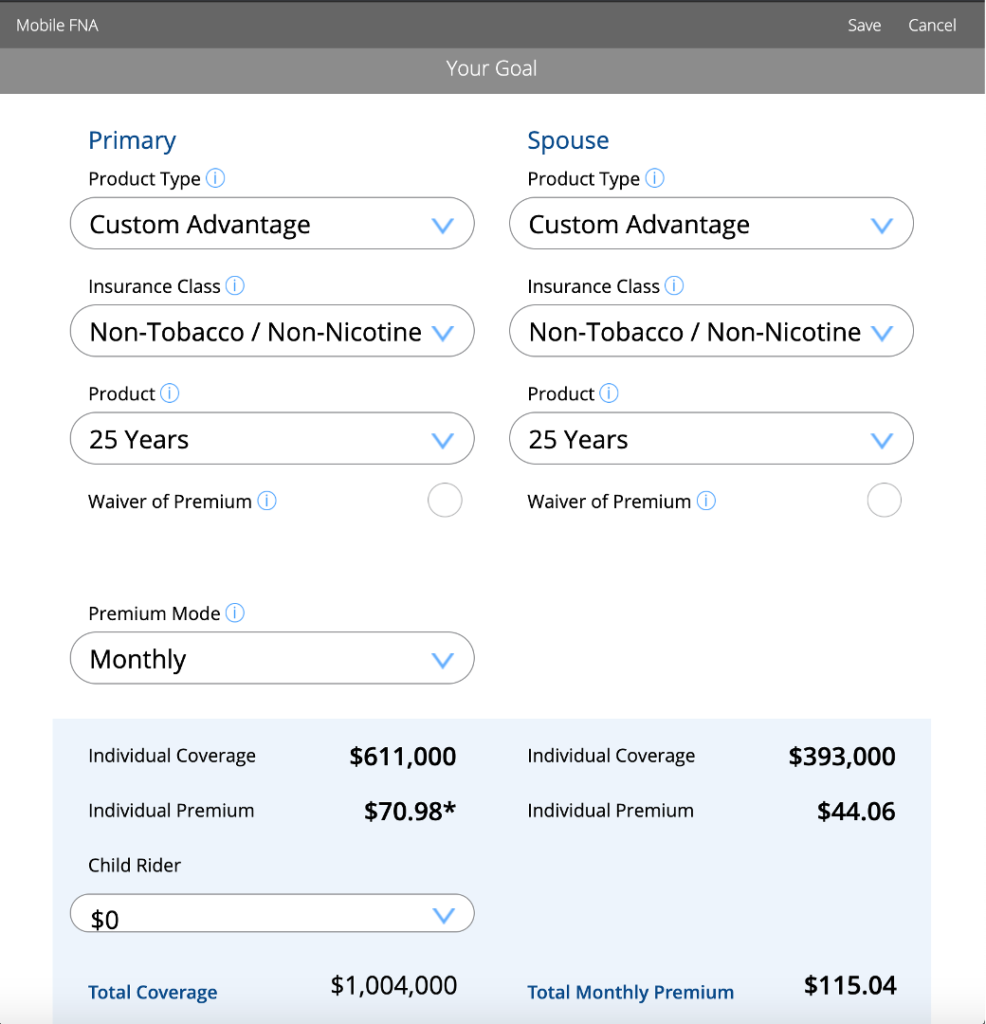

The FNA prepopulates numbers. Click on the Premium amount on the FNA Summary Page to make changes.

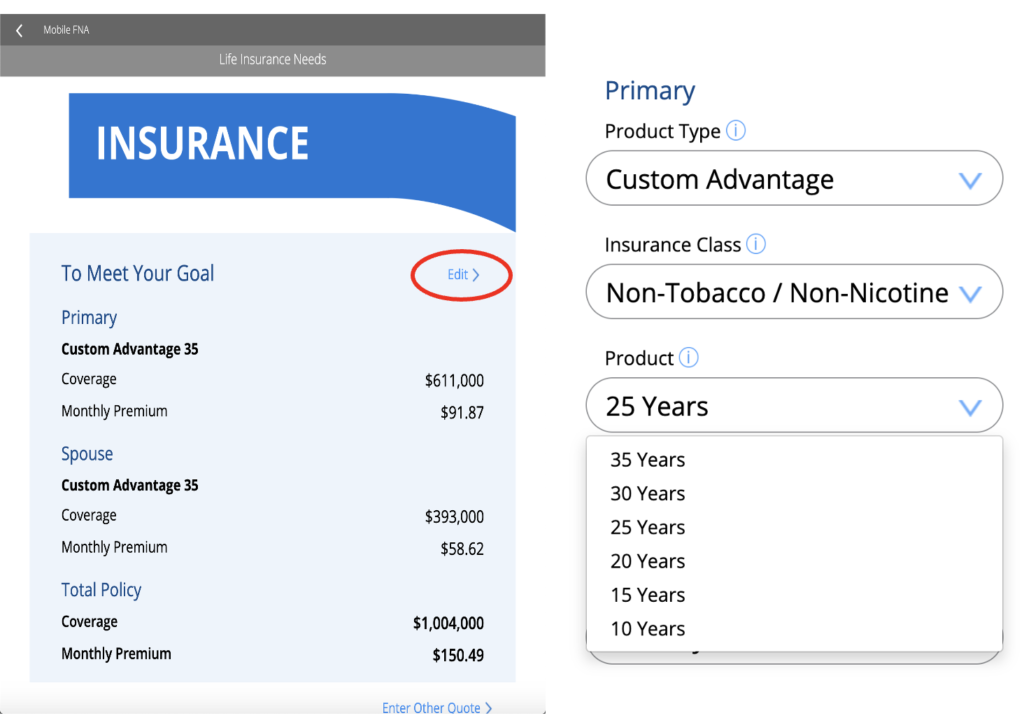

The FNA automatically selects a 35 year term, select edit and lower to the appropriate term for the client. A general rule of thumb is to take them to where their youngest child is at least 23 years of age.

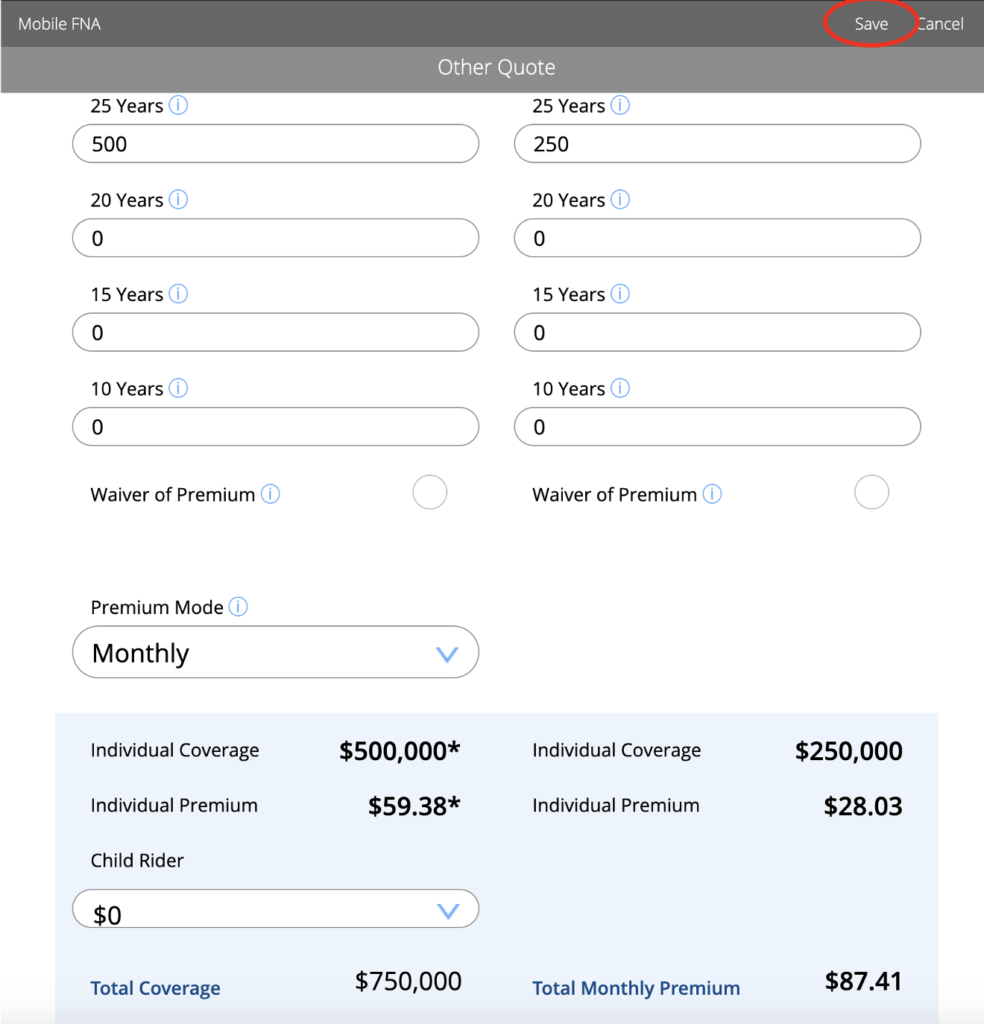

Get this quote somewhere in the ballpark of where the client said they can be, it is okay if it is a little over In this example the client said on the higher end of $50-$100 Once you have a quote you feel good about hit save.

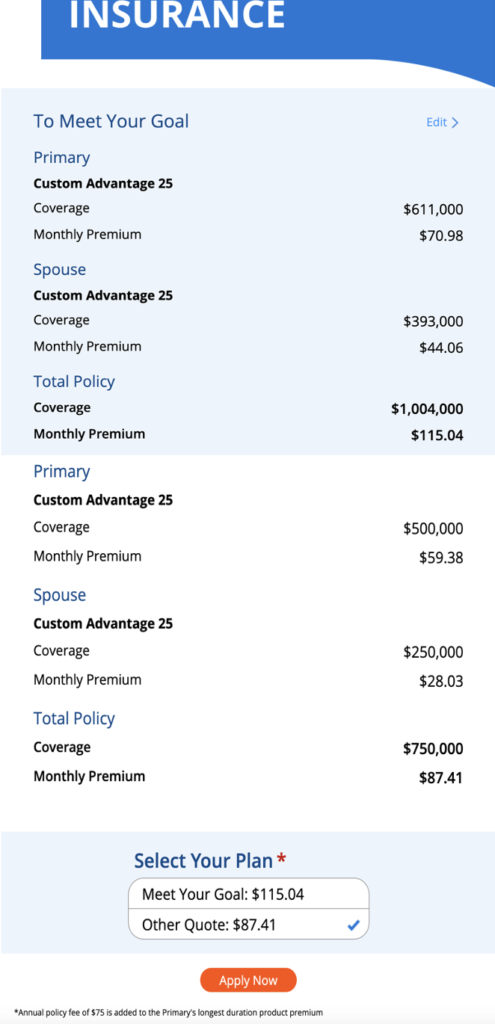

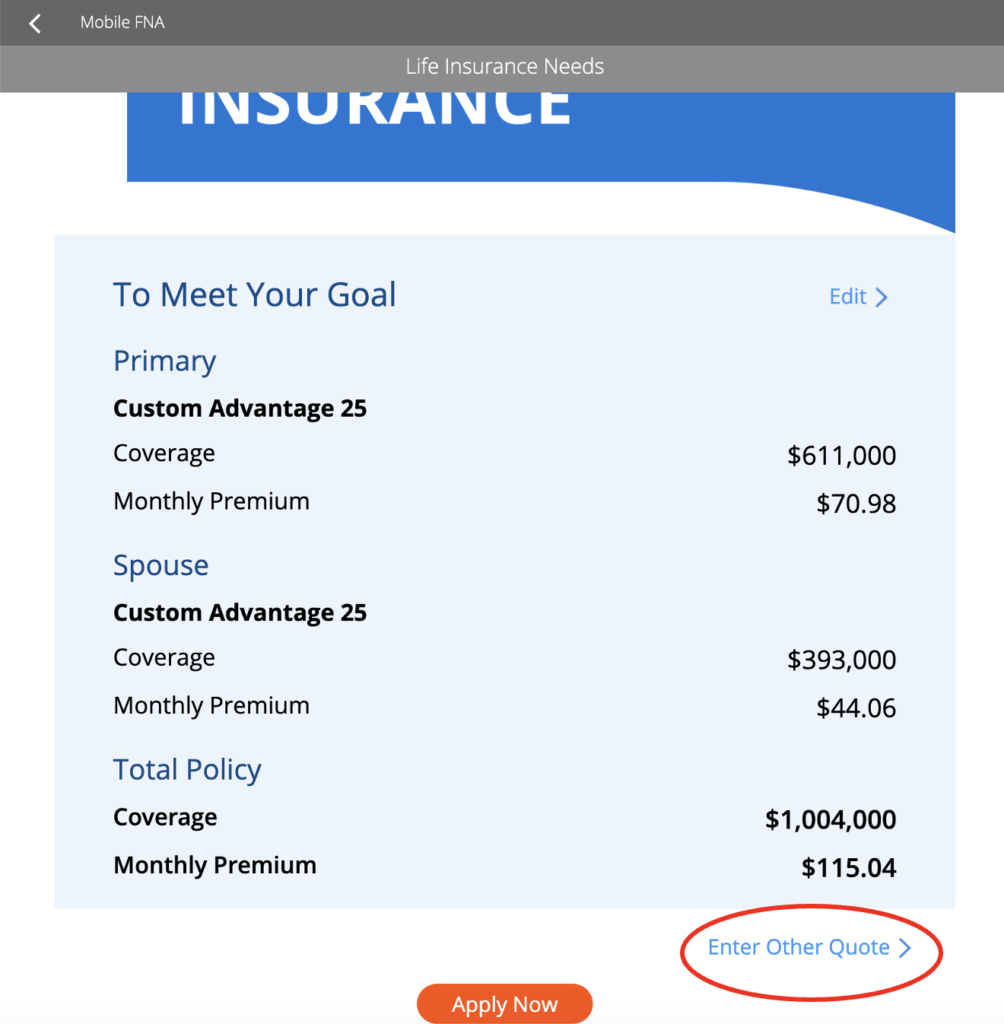

Now that you have the “To Meet Your Goal” quote in order, Click “Enter Other Quote”

Now its time to create your “Other Quote” This quote should cost less than the previous quote to give your client two options. Either lower the term or the face amount to get it in the clients price range.

Once you feel good about the quote click save.

Step 17 - Present Quotes

Share Screen and Present the quotes

Okay Mr. and Mrs. ____ I put some quotes together for you.

The first quote here is the quote we discussed that provides a rock solid, bullet proof foundation for you. It is a 25 year term, $611,000 on ______ and 25 year term for $393,000 on _____ in order to make that happen you would be looking at $115.05 per month

Now, I put a different quote together for you that is a little less, it would be $500,000 on _____ and $250,000 on _____ for $87.41 a month.

Of these two quotes here, which one would you guys feel more comfortable with? (WFA)

You would not have any issue paying that correct?

Great!